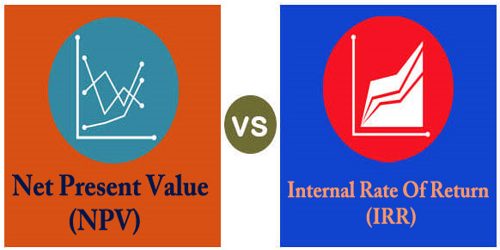

Selecting between NPV and IRR rests on the context and the specifics of the investment project. When the absolute financial impact is vital, NPV may be more appropriate. Both IRR and NPV assess the potential profitability of investments but differ in their approaches and implications. IRR is an important tool for companies in determining where to invest their capital.

Example: IRR vs NPV in Capital Budgeting

On the other hand, IRR is extensively used in leveraged buyouts (LBOs), where investors primarily focus on achieving a specific return on the capital invested. In LBO scenarios, the IRR helps determine the maximum payable price for a target company while still achieving the desired financial yield. Understanding these two metrics allows investment bankers to tailor their strategies effectively, whether they’re evaluating a potential acquisition or optimizing the financial structure of a buyout. Everything points to the net present value decision method being superior to the internal rate of return decision method.

What Is IRR?

If one were to pick one project based on internal rates of return of the projects, then one would go for Y. To reiterate from earlier, the initial cash outflow (i.e. sponsor’s equity contribution at purchase) must be entered as a negative number since the investment is an “outflow” of cash. Afterward, the positive cash inflows related to the exit represent the proceeds distributed to the investor following the sale of the investment (i.e. realization at exit).

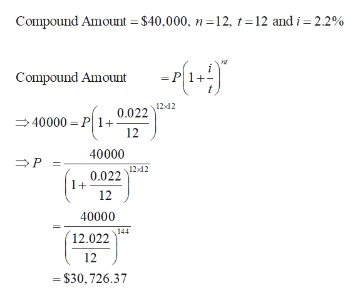

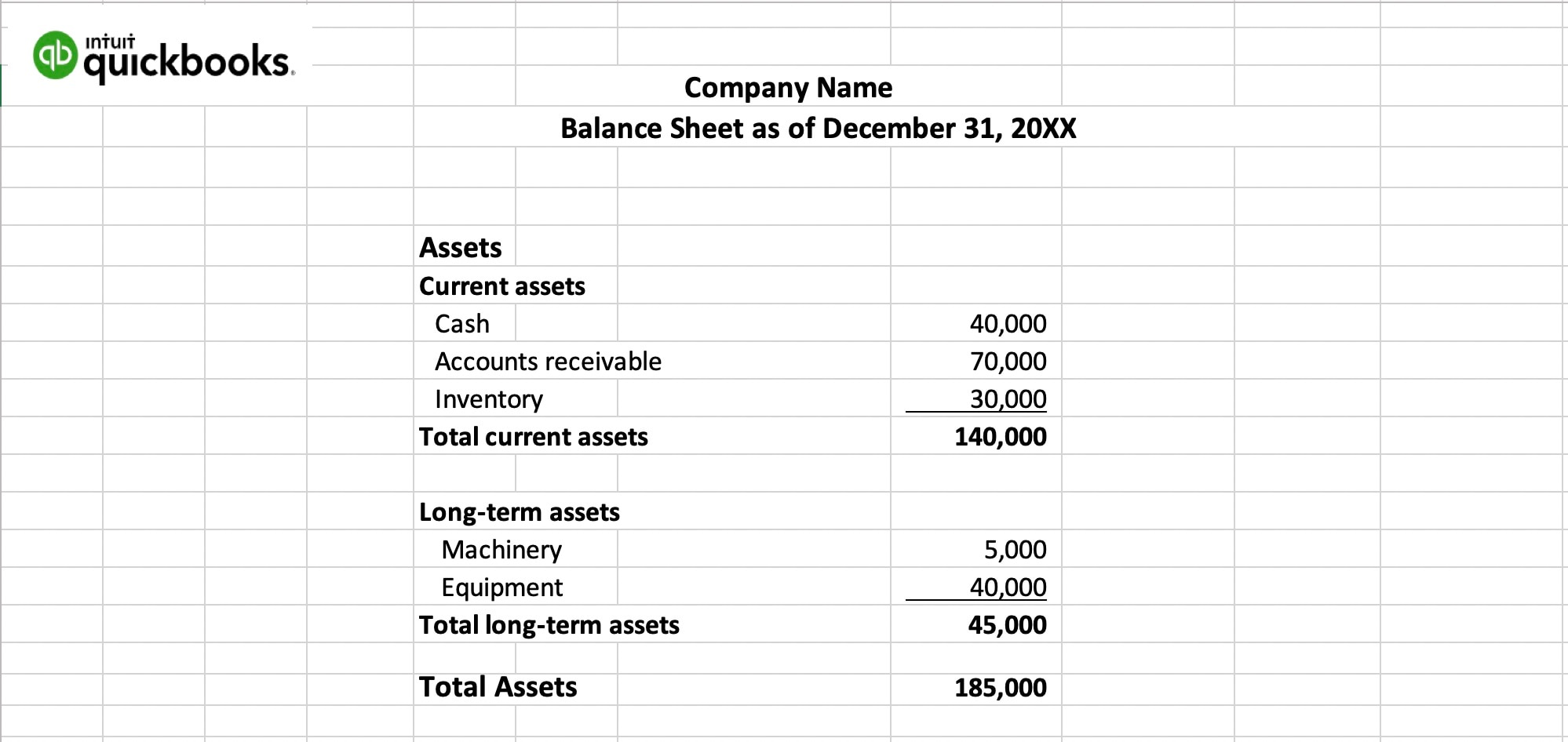

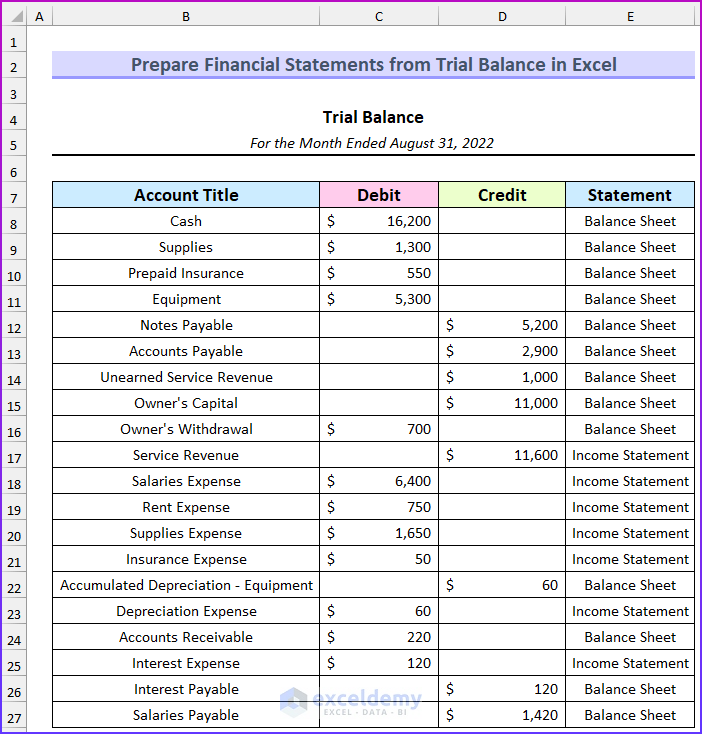

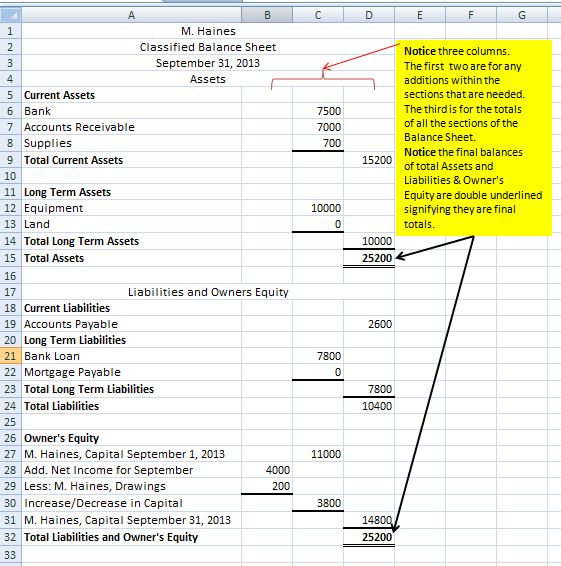

Determining NPV

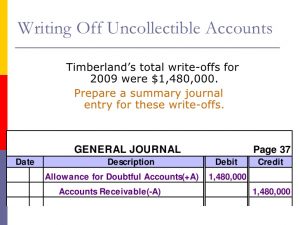

If a discount rate is not known, or cannot be applied to a specific project for whatever reason, the IRR is of limited value. If a project’s NPV is above zero, then it’s considered to be financially worthwhile. However, in comparing several potential projects past year tax a company might choose one with a lower IRR as long as it still exceeds the cost of capital. That can be because it has other benefits beyond the purely financial ones. However, if the projects are mutually exclusive, then, only one project would be chosen.

What Are NPV and IRR?

- The internal rate of return (IRR) cannot be singularly used to make an investment decision, as in most financial metrics.

- These include building out new operations, improving existing operations, making acquisitions, and so on.

- But from a more in-depth look, if the multiple on invested capital (MOIC) on the same investment is merely 1.5x, the implied return is far less impressive.

- The advantage to using the NPV method over IRR using the example above is that NPV can handle multiple discount rates or varying cash flow directions.

- The NPV is positive, meaning the project is expected to generate more cash inflows than outflows, making it financially viable.

Finance managers should weigh both metrics, considering the strategic context and specific project characteristics, to make informed investment decisions. Essentially, IRR is the rate at which discounted cash inflows equal to cash outflows. When discussing bonds, the IRR is analogous to the Yield to Maturity (YTM). To do this, the firm estimates the future cash flows of the project and discounts them into present value amounts using a discount rate that represents the project’s cost of capital and its risk. Next, all of the investment’s future positive cash flows are reduced into one present value number. Subtracting this number from the initial cash outlay required for the investment provides the net present value of the investment.

Difference Between NPV and IRR

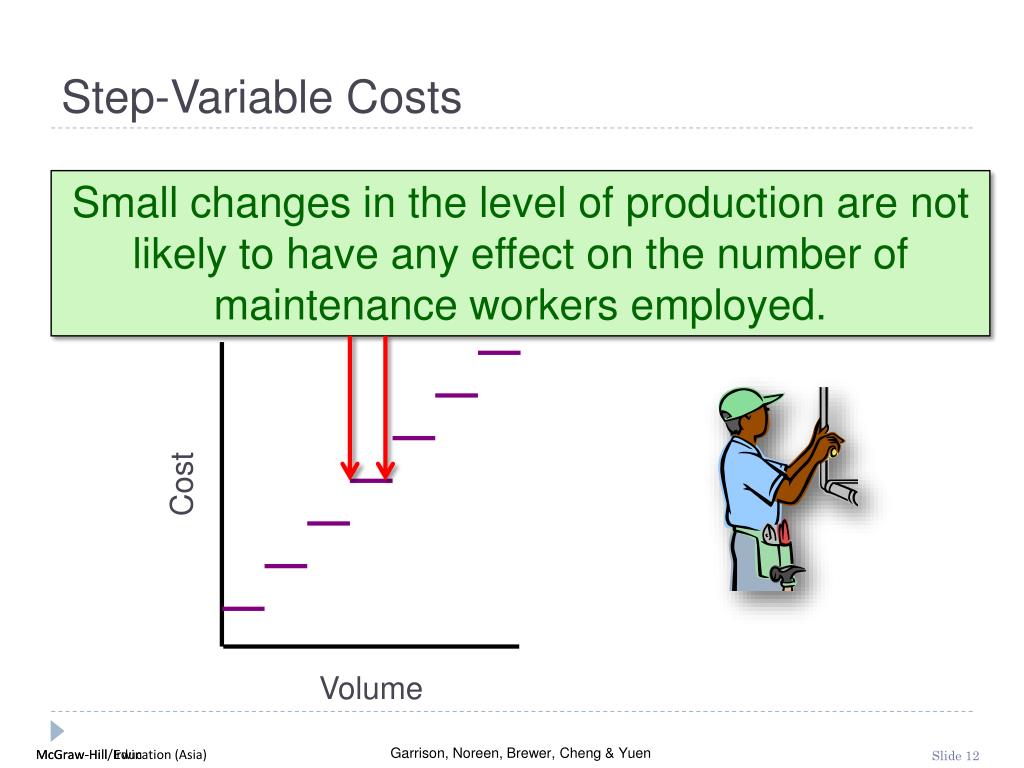

One issue that business owners also have to consider is the reinvestment rate assumption. IRR is sometimes wrong because it assumes that cash flows from the project are reinvested at the project’s IRR. However, net present value assumes cash flows from the project are reinvested at the firm’s cost of capital, which is correct. The internal rate of return (IRR) is a financial metric used to assess the attractiveness of a particular investment opportunity. When selecting among several alternative investments, the investor would then select the investment with the highest IRR, provided it is above the investor’s minimum threshold. The main drawback of IRR is that it is heavily reliant on projections of future cash flows, which are notoriously difficult to predict.

For this example, the project’s IRR could—depending on the timing and proportions of cash flow distributions—be equal to 17.15%. Thus, JKL Media, given its projected cash flows, has a project with a 17.15% return. If there were a project that JKL could undertake with a higher IRR, it would probably pursue the higher-yielding project instead. In the spreadsheet, project A results in an IRR of 17%, and project B results in an IRR of 5%. Given that the company’s cost of capital is 10%, management should proceed with Project A and reject Project B.

The entire equation is set up with the knowledge that at the IRR, NPV is equal to zero. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Net Present Value is an investment measurement that captures the total value created by an investment.

In most cases, the advertised return will include the assumption that any cash dividends are reinvested in the portfolio or stock. Therefore, it is important to scrutinize the assumptions when comparing returns of various investments. The IRR formula can be very complex depending on the timing and variances in cash flow amounts.