Factoring, on the other hand, only solves the problem of limited cash flow due to slow-paying clients. Many small businesses struggle financially, but factoring receivables is one of the most popular ways to grow a business and generate cash flow. Accounts receivable factoring can help companies provide better customer service by offering more flexible payment terms and reducing the time and effort required to collect customer payments. Let’s say a business has $100,000 in eligible accounts receivable and the advance rate is 80%.

- This corresponds to the remaining invoice amount (total invoice minus advance payment) minus the fees.

- There are plenty of small business financing options for companies needing working capital to maintain cash flow or invest in growth and expansion.

- If approved, the company receives an upfront payment for the invoices, allowing them to improve their cash flow immediately.

- In this regard, it may be highly beneficial for subcontractors to look into invoice factoring.

- Invoice factoring involves selling your unpaid invoices to a factor who becomes the owner of the debt and handles repayment, similar to a debt collector.

- Accounts receivable factoring can be invaluable during these times when companies need immediate cash flow without waiting for customers to pay invoices in full.

Avoid Complex Loan Requirements

- Depending on the client’s demands, they may factor bills weekly, monthly, or daily.

- Available to startups as well as established companies, Riviera Finance provides funding within 24 hours after invoices are verified.

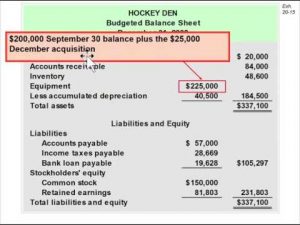

- These invoices are captured in accounts receivable, an asset account on a company’s balance sheet, which represents money owed to the company from customers for sales made on credit.

- As long as your clients have good credit, you can increase the number of factors your business maintains.

- We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide.

After deducting the factor fees ($800), Mr. X will pay back the remaining balance to you, which is $1,200 ($10,000 – $800). As a result, Company A receives a total of $9,200 ($8,000 + $1,200) from its receivables instead of the full invoice value of http://www.parlcom.ru/katalog-literatury/finansovoe-pravo/revenue-law1.html $10,000. Let’s assume you are Company A, which sends an invoice of $10,000 to a customer that is due in six months. You decide to factor this invoice through Mr. X, who offers an advance rate of 80% and charges a 10% fee on the amount advanced.

Everything you need to know about DSCR: the debt service coverage ratio

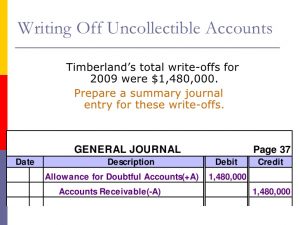

A factor is an intermediary agent that provides cash or financing to companies by purchasing their accounts receivables. In short, a factor is a funding source; the factor agrees to pay the company the value of an invoice—less a discount for commission and fees. Often, as mentioned previously, the finance company will take on the responsibility of customer credit dues. However, if enough customers don’t pay their invoices, your small business can be held accountable for the factoring company’s lost fees. This is not true in the case of a nonrecourse exchange, as the financing company assumes the nonpayment risk. Receivables factoring, also known as accounts receivable factoring, is a type of business financing in which a company sells its receivables (invoices) to a third party at a discount to raise capital.

- However, non-recourse factoring means that the factoring company accepts those potential losses.

- Construction companies, therefore, have to meet more stringent requirements to secure financing from traditional lenders.

- Purchasing a semitruck is not cheap, but commercial truck loans can help your trucking or shipping business obtain the fleet of vehicles you need.

- The factoring company pays you immediately, using the invoice as collateral.

Accounts Receivable Factoring: How It Works, How Much It Costs

The requirements are fairly straightforward and allow you to work with new clients quickly. You can consider factoring if 1) you operate a business that has commercial or government clients with good credit, and 2) your business is free of liens, other encumbrances, and legal problems. The cost of accounts receivable factoring with FundThrough is clear and upfront, involving a single fee.

It is a common practice in industries where lengthy payment terms are standard and cash flow management is critical. With receivables factoring, you are selling individual invoices, so if a customer churns, you need to replace it with an in-kind receivable. However, with receivables financing this is not the case, since individual invoices don’t matter, rather you just need to make the monthly payments. Also, typically receivables factoring is more expensive than receivables financing in terms of both the discount rate and the factoring fees. One of the primary benefits of accounts receivable factoring is improved cash flow management. By receiving immediate payment for invoices, companies can meet their financial obligations, such as paying suppliers and employees, without having to wait for customer payments.

Accounting For Factored Receivables: The Essential Guide

If your invoice is $10,000, and your customer pays after the first month, you would only owe the factoring company $100. If your customer takes 3 months to pay, you would have to pay the company $300. Factoring receivable rates vary, but ultimately, the longer your customer takes to pay the invoice, the more you’ll owe the factoring company. In this case, company XYZ sells their accounts receivable at a discounted rate, say $9,500. Each month company XYZ pays the financier a set fee until the full $10,000 is repaid. AR factoring doesn’t impact a business’ credit rating or loan interest rate.

Cost of factoring receivables

It enables businesses to finance their accounts receivable, providing instant money. Small and developing businesses that do not have big financial reserves https://mcpetrade.ru/nedvizhimost/zarubezhnaja-nedvizhimost/2017-v-ispanii-objavili-masshtabnuju-rasprodazhu-zhilja-zarubezhnaja-nedvizhimost.html frequently employ A/R factoring. Accounts receivable factoring is a sort of commercial borrowing that assists businesses with cash flow problems.

Once the client pays the invoice, usually after 30 to 90 days, the transaction is closed. Yes, you can and should negotiate the terms of receivables factoring including the repayment tenure, the discount rate, and the origination or factoring fee. Accounts receivable factoring doesn’t require collateral or impact a business’s credit rating. Because traditional loans do make those a part of the process, a business with less ideal creditworthiness might desire to avoid a credit impact, or be unable to put down collateral to maintain cash flow. With a 2% discount fee and a $500 service fee, the factoring fees would be $2,500. Therefore, the business would receive $77,500 in total, and the factoring company would make $22,500 in revenue.

Available to startups as well as established companies, Riviera Finance provides funding within 24 hours after invoices are verified. It offers non-recourse factoring and cash advance amounts up to 95% of the invoiced amount. With business lines of credit, borrowers are given a credit http://bizzteams.ru/13717-job-satisfaction.html limit and can borrow up to that amount. Accounts receivable factoring offers an advance rate, which reflects the percentage of invoice value that the factoring company is willing to float you up front. Regular factoring usually involves selling a batch of unpaid invoices all at once.