It is also possible to grasp the information found in a balance sheet to calculate important company metrics, such as profitability, liquidity, and debt-to-equity ratio. If an automobile is purchased for cash, the net worth statement is unchanged. The person has decreased cash but increased the personal‐use asset by an equal amount. As the car ages and decreases in value, the net worth statement declines by an appropriate amount.

Balance Sheet Formula

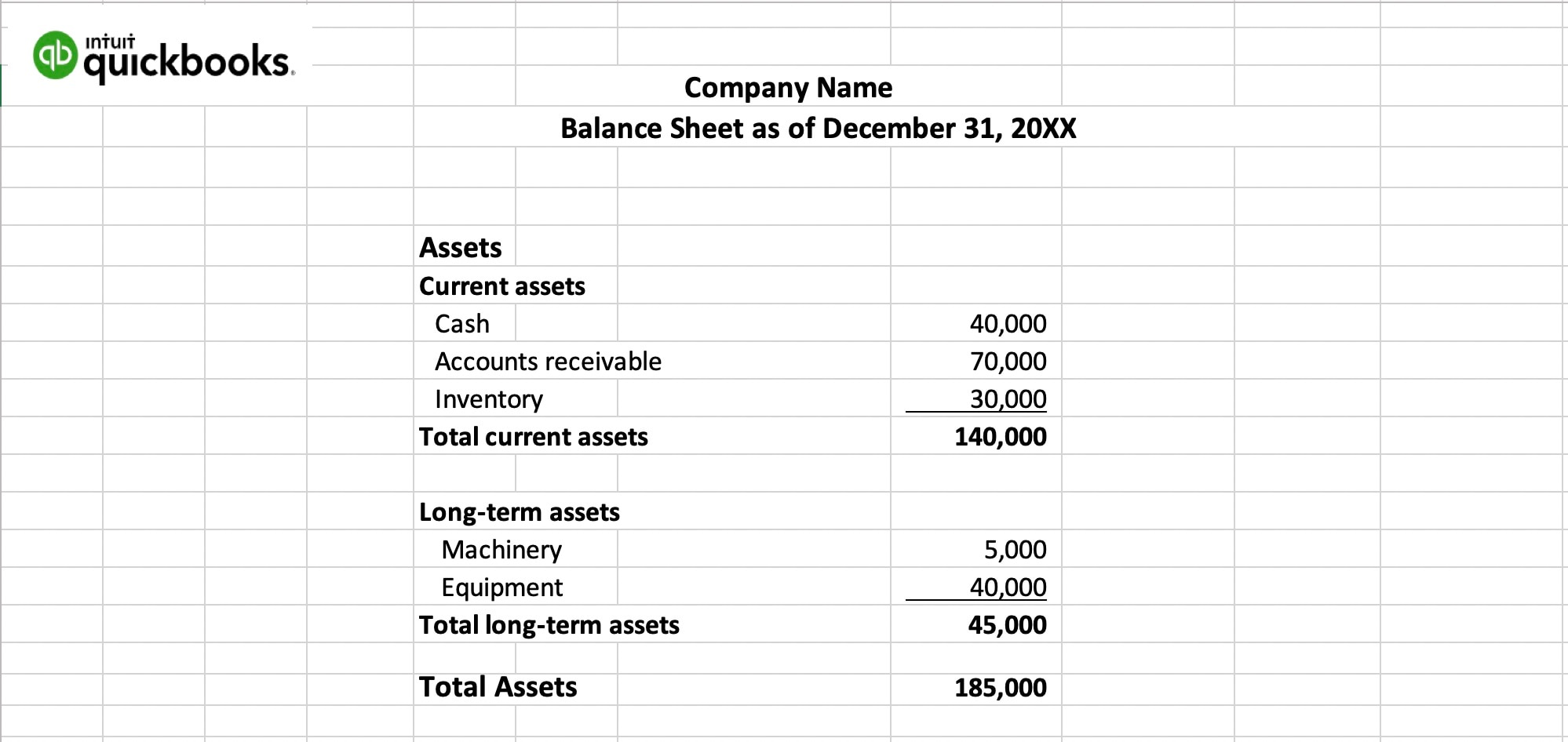

Save this printable template as a year-by-year balance sheet, or easily customize it to be a day-by-day or month-by-month balance sheet. Enter projected figures to see your financial position compared to your financial goals. When setting up a balance sheet, you should order assets from current assets to long-term assets. Long-term assets can’t be converted immediately into cash on hand. They’re important to include, but they can’t immediately be converted into liquid capital. Maintaining your business’s financial health is a key component of long-term success.

Report Format Balance Sheet

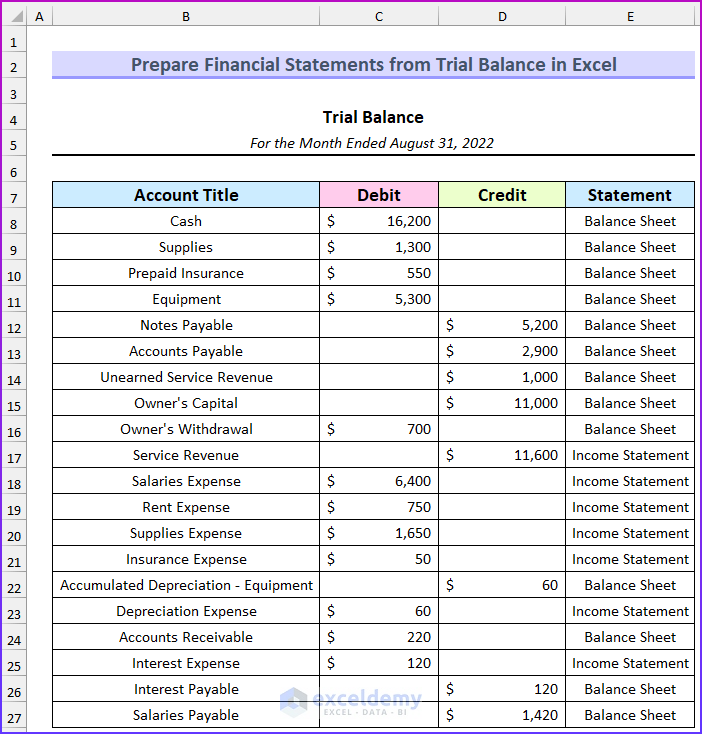

The auditor of the company then subjects balance sheets to an audit. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. Balance sheets include assets, liabilities, and shareholders’ equity. Assets are what the company owns, while liabilities are what the company owes.

Balance sheet format.

Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors. But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements. The income statement and the balance sheet report on different accounting metrics related to a business’s financial position. By getting to know the purpose of each of the reports you can better understand how they differ from one another.

This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day. Savings and investments are really payments that someone makes to themselves. The payments still represent cash flowing through to the savings or investment vehicle, so they must be accounted for. They then appear on the personal net worth statement, making that statement more positive. Fixed expenses are those that generally cannot be changed over the short term.

Accounting Ratios

Budgets are most frequently used when a family is having a financial problem. They then help set targets for spending and let everyone know why spending is limited in one area or another. A budget can help coordinate savings and improve living standards by identifying areas of waste. Bankers may require that a dentist develops a personal cash‐flow statement or family budget when borrowing money to set up or buy out a dental practice. Two forms of financial statements, personal and business, are shown in this chapter.

Although balance sheets are important, they do have their limitations, and business owners must be aware of them. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. The revenues of the company in excess of its expenses will go into the shareholder equity account. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years.

Looking under the surface of these figures lets analysts and investors see how the business is doing financially, and compare one company to another. Whatever a business owns — its assets — have been financed by either taking on debt (liabilities), or through investments from the owner or shareholders (equity). The term owners’ equity is mostly used in the balance sheet of sole proprietorship and partnership form of business.

- Assets can be classified based on convertibility, physical existence, and usage.

- Part of shareholder’s equity is retained earnings, which is a fixed percentage of the shareholder’s equity that has to be paid as dividends.

- This is consistent with the balance sheet definition that states the report should record actual events rather than speculative numbers.

- Two forms of financial statements, personal and business, are shown in this chapter.

Unlike the asset and liability sections, the equity section changes depending on the type of entity. For example, corporations list the common stock, preferred stock, retained earnings, and treasury stock. Partnerships list the members’ capital and sole proprietorships list the owner’s capital.

All of our content is based on objective analysis, and the opinions are our own. These operating cycles can include receivables, payables, and inventory. Shareholders’ equity will be straightforward for companies or organizations a sample profit and loss statement to help your business that a single owner privately holds. This will make it easier for analysts to comprehend exactly what your assets are and where they came from. Below is an example of a balance sheet of Tesla for 2021 taken from the U.S.

If they borrow and then use the money to purchase an asset, their net worth remains unchanged. As the debt is paid down or the value of the practice increases, their net worth becomes more positive. Every time a sale or expense is recorded, affecting the income statement, the assets or liabilities are affected on the balance sheet. When a business records a sale, its assets will increase or its liabilities will decrease. When a business records an expense, its assets will decrease or its liabilities will increase.